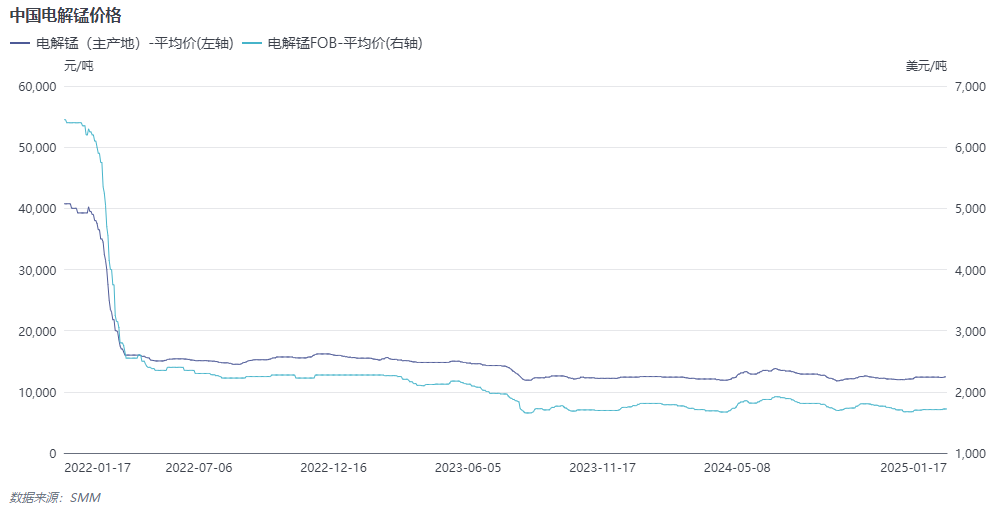

I. Price Aspect:

Quarterly Price Review:

Q1 2024: Supply side, some EMM plants resumed production after the Chinese New Year, coupled with previous inventory buildup on the supply side, leading to relatively high EMM supply. Demand side, steel mills resumed production at a slow pace after the Chinese New Year, with stable purchasing sentiment among market participants and steady spot transactions. Overall, supply and demand showed a surplus, putting downward pressure on manganese prices.

Q2 2024: Due to unexpected disruptions in Australian ore shipments, manganese ore prices surged significantly. Although EMM primarily relies on domestic ore, the rising manganese alloy prices stimulated strong sentiment to stand firm on quotes for EMM. Supply side, manganese prices fluctuated upward, and idle EMM plants resumed production, resulting in increased overall production. Demand side, the significant rise in manganese alloy prices made EMM a more economical alternative raw material, boosting demand from downstream stainless steel mills. Supported by downstream demand and strong sentiment to stand firm on quotes, spot prices for EMM fluctuated upward.

Q3 2024: Supply side, with a slight reduction in electricity costs, production costs for EMM plants decreased, and some EMM plants undergoing maintenance gradually resumed production, leading to sufficient overall EMM supply. Demand side, steel mills faced increased shutdowns and maintenance due to high temperatures and rainy seasons, entering the traditional off-season for demand, with weaker enthusiasm for EMM procurement. Additionally, steel mills, facing production losses, exerted pressure on raw material prices, showing low acceptance of high-priced EMM. Spot prices for EMM fluctuated downward. Later, as downstream steel mills slightly recovered their demand for EMM, EMM prices rebounded.

Q4 2024: Supply side, EMM plants showed weak willingness for production cuts, maintaining high production levels. Demand side, with the completion of fixed orders by large manganese plants and the entry of downstream manganese-aluminum alloy and Mn3O4 sectors into the off-season, production declined, leading to a noticeable drop in overall EMM demand. Later, as steel mills stockpiled before the Chinese New Year, their acceptance of high-priced EMM remained low. However, EMM plants showed strong sentiment to stand firm on quotes before the Chinese New Year, with weak willingness to sell at low prices. The market experienced a tug-of-war between supply and demand, with prices stabilizing before a slight rebound due to tightened spot market circulation.

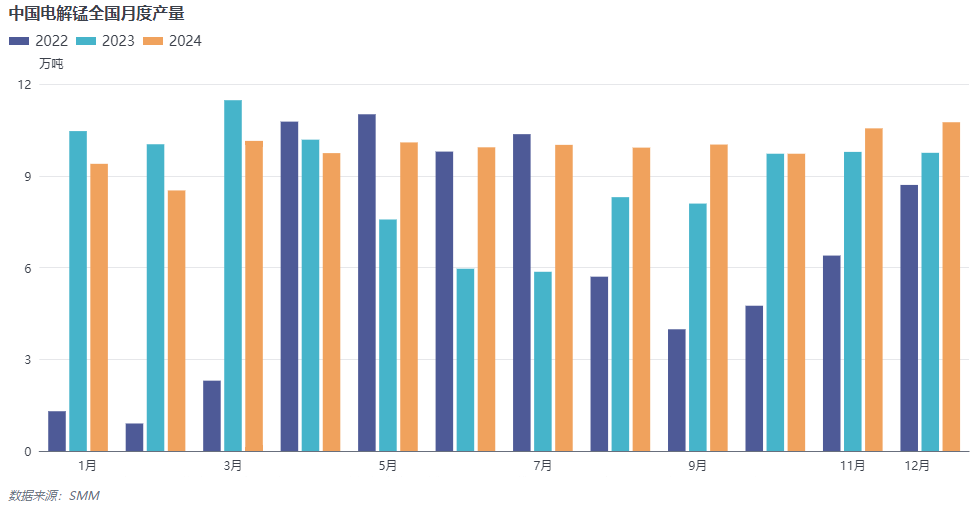

II. Supply Aspect:

According to SMM data, China's total EMM production in 2024 was approximately 1.188 million mt, an 11% YoY decrease compared to 2023. The overall production increase was significant, mainly due to two factors. On one hand, the total stainless steel production schedule increased compared to 2023, driving up demand for EMM and boosting production. On the other hand, the impact of unexpected disruptions in manganese ore imports led to soaring raw material costs, significantly raising manganese prices. As EMM plants used domestic manganese carbonate ore, their profit margins expanded, strengthening their willingness to resume production. Consequently, overall EMM production increased.

III. Demand Aspect:

Export Aspect:

From January to November 2024, China's total EMM exports were approximately 377,000 mt, a 7.3% increase compared to 2023. The top five destinations for exports of unwrought manganese, scrap, and powder were the Netherlands, Japan, Russia, South Korea, and the US. The top five destinations for exports of wrought manganese and manganese products were the US, India, the Netherlands, Japan, and Russia.

Domestic Aspect:

Downstream demand for EMM is primarily in stainless steel, especially 200-series stainless steel. Additionally, it is used in special steel, manganese-aluminum alloys, and Mn3O4. In 2024, stainless steel production schedules increased, leading to higher EMM consumption. Furthermore, other sectors in the consumer market grew rapidly, consuming more EMM, resulting in increased annual demand for EMM.

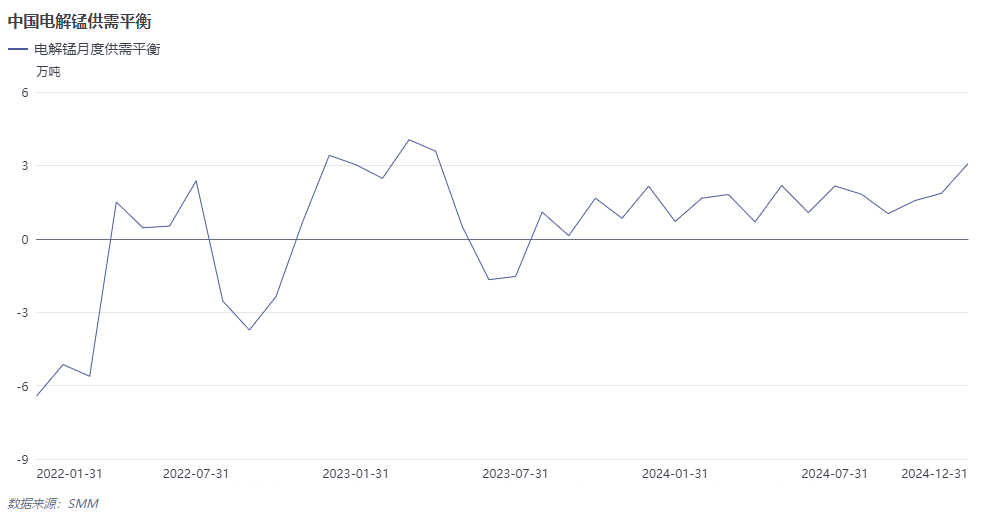

IV. Supply and Demand Aspect:

Supply side, in 2024, large EMM plants maintained high operating rates, and many small and medium-sized EMM plants resumed production. As a result, EMM production increased. Demand side, in 2024, production schedules for stainless steel and other sectors increased, driving up demand for EMM. Additionally, when other manganese alloys were less economical, downstream purchasing of EMM increased periodically.

V. Outlook for 2025:

Supply side, due to restrictions on mining activities, manganese carbonate ore is expected to remain tight, leading to a shortage of raw materials for EMM. Coupled with the current inventory buildup of EMM, the supply surplus situation is expected to persist. EMM plants may consider controlling production. Demand side, as profit margins for stainless steel mills continue to shrink, their production schedules are expected to decrease, leading to a potential decline in EMM procurement. Additionally, other manganese alloys will continue to substitute EMM, and EMM's economic advantage will remain weak. Regarding spot prices, due to reduced downstream production schedules and EMM's lack of economic advantage, demand for EMM is expected to decrease. Furthermore, with restrictions on manganese carbonate ore mining, long-term cost support may strengthen. Therefore, after destocking, spot prices for EMM are expected to fluctuate within a reasonable profit range.

》Subscribe to View Historical Price Trends of SMM Manganese Products

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)